It’s hard to overstate how American comedians debased themselves for Saudi blood money.

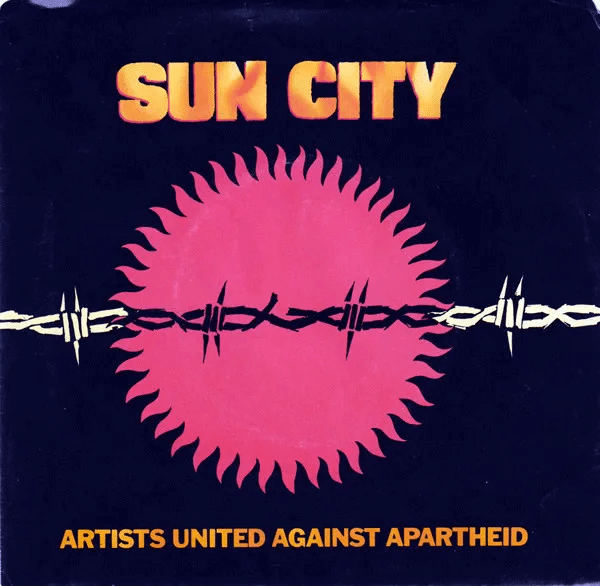

In 1985, under the banner of Artists United Against Apartheid, guitarist Steven Van Zandt and producer Arthur Baker brought together more than 50 artists from rock, hip-hop, jazz and world music to record the protest song “Sun City” and its accompanying album.

Their message: We will not perform at Sun City, the luxe whites-only South African resort that stood as a symbol of apartheid’s inequality.

It was a defiant stand that declared some gigs just aren’t worth the money.

Four decades later, American comedians have done the opposite. And the moral backslide is breathtaking…

Send your opinions to, feedback@newsyoucanacton.com

Your Rundown for Wednesday, October 22, 2025...

No Laughing Matter

The Riyadh Comedy Festival (Sept. 26–Oct. 9, 2025) was marketed as the “world’s largest” celebration of stand-up and promoted as proof of new openness in the Kingdom.

The event was part of a broader strategy: Saudi Arabia’s buying golf, soccer, video gaming and now stand-up comedy to… sandblast its bloody reputation.

It’s ironic, for example, that the festival coincided with the grim anniversary of journalist Jamal Khashoggi’s disappearance.

On Oct. 2, 2018, the Saudi dissident and U.S. resident walked into the Saudi consulate in Istanbul to apply for marriage documents. And he never walked out.

A UN special report later concluded there was “credible evidence” of a state-sanctioned murder, and Washington’s own assessment pointed to Saudi responsibility at the highest level.

Meanwhile, Riyadh’s Deera Square is located about 15 miles away from the comedy festival’s venue. Known as “Chop-Chop Square,” the site hosted public beheadings on Fridays until 2019.

Today, if you can believe it, the same plaza has been remade into an entertainment complex where visitors can sip specialty “mocktails,” dine at pricey restaurants and browse souvenir shops.

The bloodshed, nonetheless, continues.

In 2024, Saudi Arabia executed at least 345 individuals — some of them minors, many for drug offenses. It’s the highest number in decades, according to Amnesty International.

Then there’s neighboring Yemen where years of Saudi-led airstrikes and blockades on ports and airspace have helped drive one of the worst humanitarian crises in modern history.

This year alone, officials warn more than 17 million Yemenis are malnourished, including over 2 million starving children under age five.

Despite this, the comedy festival’s marquee looked like an arena tour of A-list comics: Dave Chappelle, Kevin Hart, Louis C.K., Pete Davidson, Whitney Cummings, Bill Burr and many more.

These comedians accepted six-to-seven figure paychecks, took the stage under a state-sponsored banner and signed contracts with clauses forbidding criticism of Saudi royals and religion.

How did these prominent “truth tellers” explain their involvement?

- Louis C.K. pointed to the presence of a lesbian Jewish comic in the lineup — as if that somehow absolved participants

- Whitney Cummings dismissed critics as “racist,” dodging the issue of human rights

- And Bill Burr praised the polite audience and said the royals “loved the show.”

So glad to hear that Saudis yukked it up… But I’m not laughing.

It’s hard to overstate how these court jesters debased themselves for blood money.

In another era, artists united to boycott regimes like Saudi Arabia.

In 2025, they headline them.

Market Rundown for Wednesday, October 22, 2025

S&P 500 futures are up 0.05% to 6,775.

Oil is up 2% to $58.45 for a barrel of WTI.

Gold’s down 1.40% to $4,050.90 per ounce.

Bitcoin is down 3.40% to $108,160.